This video looks at the strategic context for Autonomous Vehicles which is one of the biggest disruptions facing the automobile industry. In particular, it provides a structured approach for aligning stakeholders with strategies to manage such disruptions.

- Situation: Large, ambitious, successful company in a huge industry

- Challenge: How to exploit the disruption to drive growth (increased market share and shareholder return) whilst maintaining its values

"One thing is certain – the future cannot be predicted, but it can be planned for"

Author of 39 Management Books, Father of Modern Management - Peter Drucker

Autonomous Vehicle Disruption

The automobile is integral to the very fabric of human existence and so it’s no surprise that new entrants and new disruptions regularly make the news with bold claims.

"The benefits of Autonomous Vehicles are mind-boggling. They will avoid 90% accidents, will reduce the costs of transportation by as much as 80% while giving the average person 300 hours of extra time annually"

Founder of PRTM, Michael E. McGrath [1]

A simulation of an Autonomous Intersection

This frightening autonomous intersection simulation demonstrates the potential for improving traffic throughput, but also illustrates how far the technology must evolve before it could be safely introduced.

Getting the automotive business model right

However, the economic model must also work: it must be affordable and make money. The automotive industry produces complex engineered products at affordable prices due to massive scale. In 1946, Peter Drucker named the automobile industry “the industry of industries” [2] and with worldwide revenues of $1.7 trillion [3] the label stuck for good reason.

Successful automotive strategies rely on high volumes, predictable demand and short development cycles that exploit architectural reuse but maintain differentiation through constant technology refreshes.

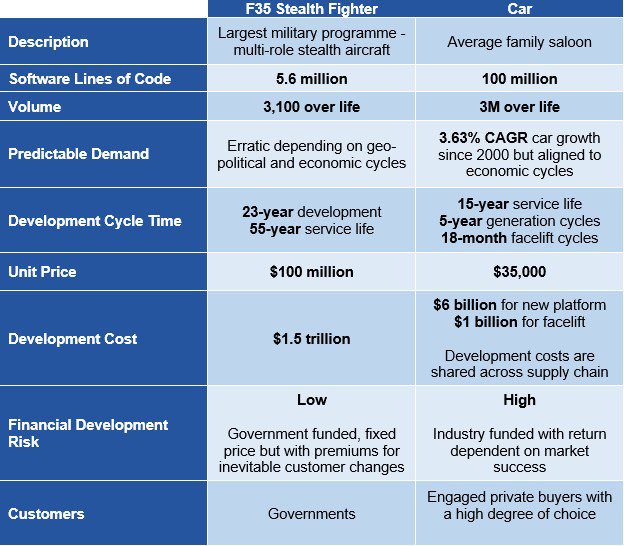

Contrast automotive to defence

Autonomous Vehicles will have much in common with modern fighter aircraft. They both have complex sensor systems monitoring the environment, sophisticated vehicle control systems and auto-pilot systems.

Already cars have 20 times more software code than a modern F35 jet fighter costing $100M [4]. Although, the comparison is crude it highlights the key factors that make cars affordable rather than prohibitively expensive. The table below spells out the major differences.

The importance of engaged private buyers

Automotive companies pay a high price for a vehicle launch flop and so they have evolved sophisticated marketing mechanisms for making the right call when it comes to customer requirements. There is little room for indulging extreme customer requirements that compromise the architectural requirements for volume and low cost.

These requirement trade-offs are almost impossible to make when the customer is paying for the development which is the case for military developments. Therefore, the fundamentals of the automotive industry that guarantees flexible but affordable transportation are:

- High volume

- Predictable rising volumes

- Rapid cycle time

- Low price

- Engaged private buyers

A structured approach for winning with technology disruptions

The aim is to make it easy to align the whole enterprise behind the disruptive automotive strategy by incorporating these three fundamentals:

- A carefully crafted, clear, communicable, winning strategic summary which expresses the vision and massive transformative purpose

- Buy-in with key stakeholders across the supply chain to establish your growth DNA

- A roadmap that links the strategic vision back to current products through a progression of evolutionary developments

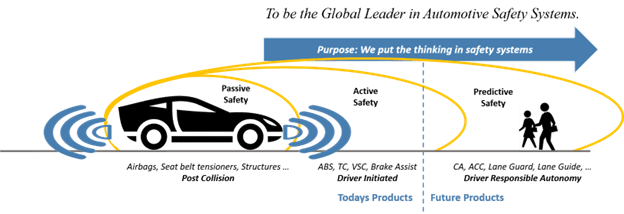

Example: Advanced Driver Assistance Systems Strategic Summary

In the case of Advanced Driver Assistance Systems [5], the progression of our products went from passive, active to predictive safety and the result is an industry that is projected to reach USD 78.19 billion by 2020. Every stakeholder was aligned and knew their role in making this disruption fruitful.

Advanced Driver Assistance Roadmap

We were also getting the benefits of the strategy long beforehand as the vehicle OEMs would reward us with short-term orders for foundation brakes just because we were a credible partner for the future. Lucas became TRW which in turn became ZF but the same strategy still persists today.

Raglan Tribe, Peter Drucker and Alan Jacobs-Cook developing the TRW ADAS strategy in 1999

What next?

All my colleagues at aczel&co have been through similar experiences, we specialise in thinking through these hard problems to develop robust growth strategies that win today and in the future. Our team has experience of working in industries with very different clock speeds from Software, Automotive through to Nuclear Submarines.

We would welcome the opportunity to meet with you to discuss your business growth journey.

Thank you.

References

- Michael E. McGrath (2018), Autonomous Vehicles: Opportunities, Strategies, and Disruptions

- Peter Drucker (1946), The Concept of the Corporation, John Day, New York

- Ten Forecasts for the Automotive Sector - A $1.7 Trillion Market - Research and Markets

- NASA Study on Flight Software Complexity, 2009

- Russell Wilson-Jones, Raglan Horatio Andrew Harold Tribe, Michael Appleyard, Patent EP0640903B1, A driver assistance system for a vehicle